In the United States, in addition to the federal personal income tax, many states also impose state personal income tax on residents. However, as of 2025, there are still 9 states that completely exempt local residents from personal income tax, which attracts a large number of individuals and entrepreneurs who want to reduce their tax burden.

In the United States, in addition to the federal personal income tax, many states also impose state personal income tax on residents. However, as of 2025, there are still 9 states that completely exempt local residents from personal income tax, which attracts a large number of individuals and entrepreneurs who want to reduce their tax burden.

There are three types of state personal income tax in the United States:

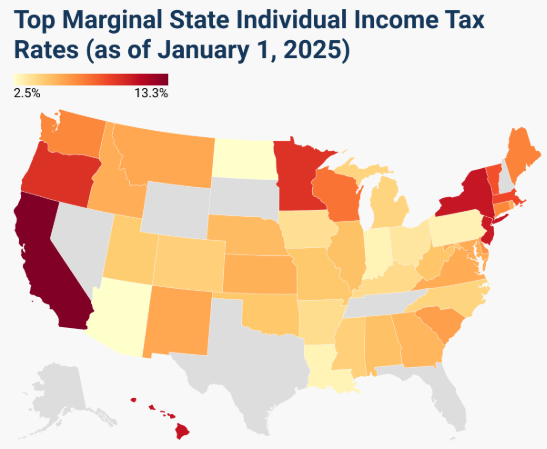

no tax, flat tax rate, and progressive tax rate, of which the progressive tax rate is adopted by most states.

No tax

Among the 50 states and the capital Washington in the United States, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming do not impose personal income tax.

Flat tax rate

That is, no matter what level of income you are at, you need to pay taxes at the same tax rate.

Progressive tax rate

According to different income levels, marital status and various tax relief conditions, the tax rates are different and cannot be ranked by a single standard.

List of tax-free states in 2025

The following are the nine states that will not be subject to state personal income tax as of 2025:

Alaska

Florida

Nevada

South Dakota

Texas

Washington

Wyoming

Tennessee

New Hampshire (only interest and dividends are taxed, not labor income)

Advantages of tax-free states

·Directly reduce the tax burden

·Residents do not need to pay taxes to the state government on labor income, which is particularly suitable for high-income groups.

·Attract high-net-worth people and corporate headquarters to move in

For example, Texas, Florida and Washington have long been popular places for corporate relocation.

·Higher flexibility in financial planning

·More tax advantages in investment income management.